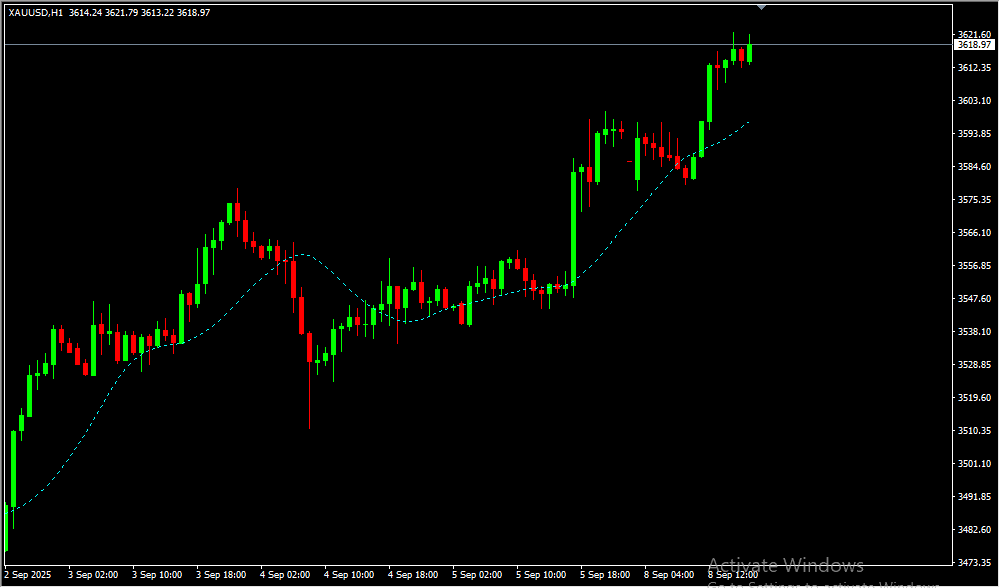

The True Range Envelopes MT4 Indicator is a custom-built tool that helps traders understand and respond to market volatility. Instead of relying on fixed bands, it uses the Average True Range (ATR) to automatically adjust envelope width. When volatility rises, the bands expand — and when markets calm down, they contract. This dynamic behavior makes it far more reliable than static indicators, especially in fast-changing conditions.

⚙️ Why Traders Use It

Traders prefer the True Range Envelopes because it helps identify potential reversal and breakout zones with high accuracy.

When the price touches or moves outside the envelopes, it often signals overextension — a point where a reversal or pullback is likely. This helps traders:

-

Avoid chasing trades at extreme price levels.

-

Time entries with better precision.

-

Manage risk by identifying exhaustion points before the market turns.

By adapting to volatility, this indicator gives a more natural, real-time sense of market rhythm.

💡 How It Improves Trading Decisions

The True Range Envelopes are not just for reversal spotting — they also work as a trend confirmation tool.

-

When price stays near the upper envelope, it indicates strong bullish momentum.

-

When price remains near the lower envelope, it signals bearish pressure.

Combining this with moving averages, RSI, or MACD adds an extra confirmation layer, helping traders filter out false signals and make data-driven decisions.

This results in improved accuracy and more consistent trade execution.

🌍 Versatility Across All Markets

One of the standout benefits of the True Range Envelopes MT4 Indicator is its versatility.

It works seamlessly on Forex, indices, commodities, and even stocks.

Because the envelopes adjust automatically using volatility data, there’s no need to change settings for different instruments or timeframes.

Whether you’re scalping on the 15-minute chart or swing trading on the daily chart — it adapts perfectly to your trading style.

🧭 How to Trade with True Range Envelopes MT4 Indicator

Buy Entry

-

Wait for the price to touch or move slightly below the lower envelope.

-

Confirm the overall trend is bullish on higher timeframes or with a moving average.

-

Look for a bullish reversal pattern (e.g., pin bar, engulfing, hammer).

-

Enter a buy trade once price starts moving back above the lower band.

-

Place stop-loss a few pips below the recent swing low.

-

Target the middle or upper envelope for taking profit.

Sell Entry

-

Wait for the price to touch or move slightly above the upper envelope.

-

Confirm the overall trend is bearish on higher timeframes.

-

Look for a bearish reversal pattern (e.g., shooting star, engulfing, doji).

-

Enter a sell trade once price moves back below the upper band.

-

Place stop-loss above the recent swing high.

-

Target the middle or lower envelope for profit-taking.

🏁 Conclusion

The True Range Envelopes MT4 Indicator gives traders an edge by combining volatility analysis with trend confirmation. It adapts to changing conditions automatically, identifies overbought and oversold zones, and simplifies trade timing. Whether you’re a beginner or a professional trader, this indicator helps refine your strategy, reduce mistakes, and stay aligned with real market behavior.

A must-have for anyone who values precision, adaptability, and clear trading signals.

Risk Disclaimer

- TrendCharts.in and its associated products, services, software, and tools do not provide any offer or solicitation to buy or sell securities, futures, forex, commodities, or derivatives.

- We are not SEBI Registered Investment Advisors or Research Analysts.

- All materials are strictly for educational, informational, and paper trading & help in analysis purposes only.

- We do not provide advice for Real Money Trade, tips, buy/sell recommendations, or investment strategies.

- TrendCharts is solely involved in the development, sell, resale, and distribution of financial market software, datafeeds, indicators, scanners, and tools.

- All our offerings are intended for testing strategies and educational evaluation only—not for real-money trading.

- Users may utilize the software and tools for paper trading or strategy evaluation only.

- If users apply our offerings to actual trading (knowingly or unknowingly), TrendCharts.in or its stakeholders bear no responsibility for any profit or loss.

- Any such use is at the user’s sole discretion and risk.

- We explicitly disclaim liability for any financial loss, trading loss, or damages resulting from:

- Use of our software, tools, or services.

- Decisions made based on any charts, indicators, AFLs, data, or analysis from our products.

- All market data and content provided are subject to delays, inaccuracies, or errors.

- Past performance (actual or hypothetical) is not indicative of future results.

- Hypothetical or backtested performance may not reflect the impact of actual market conditions.

- Trading and investing involve substantial financial risk and can result in loss of capital beyond the initial investment.

- Users must use individual discretion and independent judgment while interpreting signals, strategies, or chart setups.

- Automated signals or scanners are tools for evaluation—not trading instructions.

- TrendCharts content does not account for personal financial conditions, goals, or investment profile.

- Before making any financial decisions, consult with a licensed financial advisor or SEBI-registered professional.

- Do not rely solely on any information presented on our site for actual trades.

- Datafeeds and information may be delayed as per data vendor policies or exchange requirements.

- We do not guarantee the real-time accuracy, timeliness, or completeness of such data.

- No legal claim may be made against us or our data providers based on inaccuracies.

- Any user testimonials are individual opinions and may not represent the typical user experience.

- Hypothetical performance results involve inherent limitations and should not be relied upon for real-money decisions.

- All opinions, data, signals, and analyses shared on the website are subject to change without notice.

- TrendCharts reserves the right to modify tools, content, and services at its discretion.

- Our software or product names are for branding purposes only and do not imply any market prediction or financial guarantee.

- No claim is made regarding profitability from any software usage.

- All content—charts, indicators, tools, or data—is designed for testing, analysis, and learning.

- No real-money trading or investment recommendations are provided or supported.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Always remember

Always remember my 3R Rule

my 3R Rule : If the money

: If the money is yours then, risk

is yours then, risk , reward

, reward and regret

and regret are solely yours.

are solely yours.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose. Always remember

Always remember my 3R Rule

my 3R Rule : If the money

: If the money is yours then, risk

is yours then, risk , reward

, reward and regret

and regret are solely yours.

are solely yours.