Overview

-

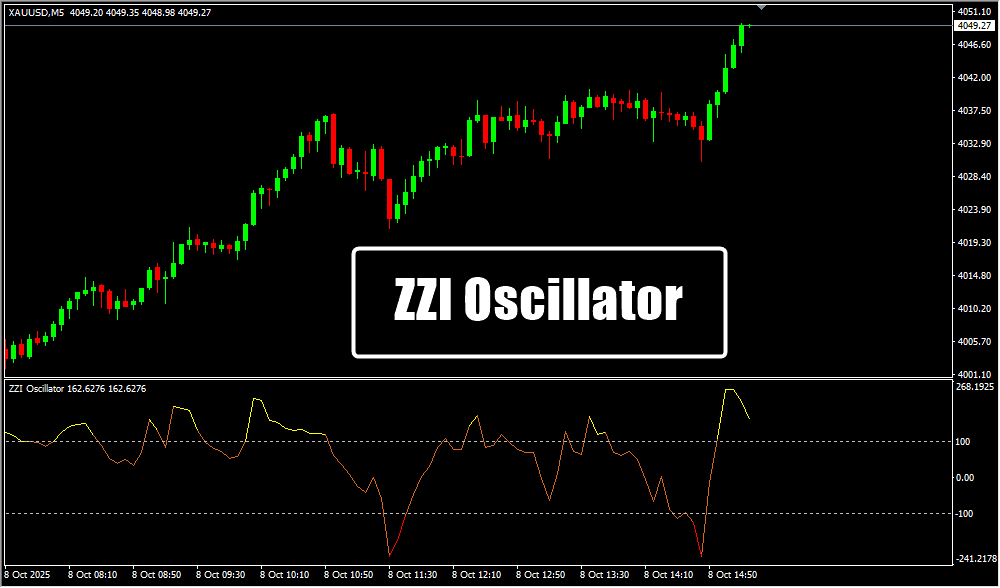

The ZZI Indicator is a powerful oscillator for MetaTrader 4 (MT4) that helps traders detect potential market reversals.

-

It measures price momentum and displays its signal line in a separate window beneath the chart.

-

The indicator visually marks overbought (yellow) and oversold (red) conditions, making buy and sell opportunities easy to identify.

How the Indicator Works

-

The oscillator line moves between predefined threshold levels.

-

Red Zone → Oversold condition → Potential buy signal

-

Yellow Zone → Overbought condition → Potential sell signal

-

Neutral zone represents normal price movement without reversal pressure.

-

Changes in color act as immediate visual cues for traders.

Specification Summary

Categories:

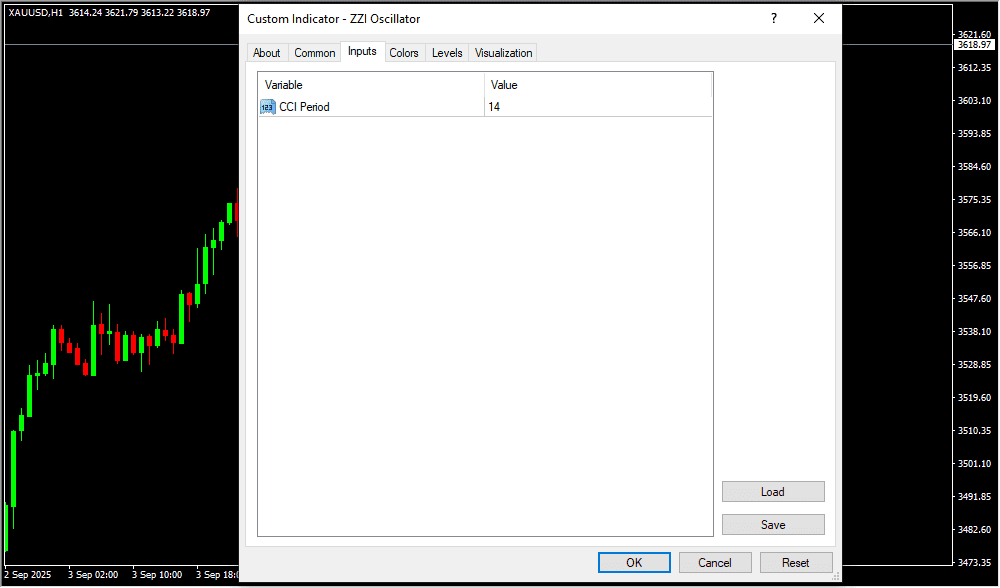

Platform: MT4

Skill Level: Elementary

Timeframes: Multi-Timeframe

Trading Types: Scalping, Day Trading, Swing Trading

Markets: Forex, Crypto, Stocks, Indices, Commodities

ZZI Indicator – Key Features

-

Simple and effective overbought/oversold detection

-

Clear color-coded reversal signals

-

Works well in ranging and swing conditions

-

Helps identify early trend reversals

-

Highly suitable for beginner to intermediate traders

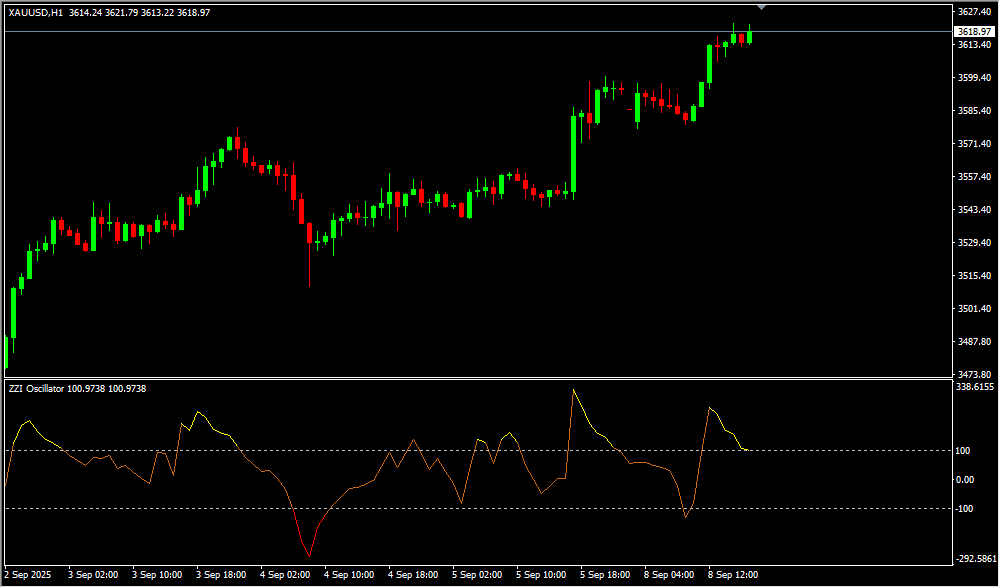

Bullish Trend Example (Buy Signal)

-

1-hour EUR/USD chart:

-

The oscillator enters the oversold zone and turns red.

-

This color shift signals potential bullish reversal conditions.

-

Traders may look for buy opportunities as the oversold zone often precedes upward movement.

Bearish Trend Example (Sell Signal)

-

4-hour USD/CHF chart:

-

The signal line enters the overbought zone and turns yellow.

-

This indicates selling pressure and a potential downward reversal.

-

Traders may consider short setups based on this alert.

Risk Disclaimer

- TrendCharts.in and its associated products, services, software, and tools do not provide any offer or solicitation to buy or sell securities, futures, forex, commodities, or derivatives.

- We are not SEBI Registered Investment Advisors or Research Analysts.

- All materials are strictly for educational, informational, and paper trading & help in analysis purposes only.

- We do not provide advice for Real Money Trade, tips, buy/sell recommendations, or investment strategies.

- TrendCharts is solely involved in the development, sell, resale, and distribution of financial market software, datafeeds, indicators, scanners, and tools.

- All our offerings are intended for testing strategies and educational evaluation only—not for real-money trading.

- Users may utilize the software and tools for paper trading or strategy evaluation only.

- If users apply our offerings to actual trading (knowingly or unknowingly), TrendCharts.in or its stakeholders bear no responsibility for any profit or loss.

- Any such use is at the user’s sole discretion and risk.

- We explicitly disclaim liability for any financial loss, trading loss, or damages resulting from:

- Use of our software, tools, or services.

- Decisions made based on any charts, indicators, AFLs, data, or analysis from our products.

- All market data and content provided are subject to delays, inaccuracies, or errors.

- Past performance (actual or hypothetical) is not indicative of future results.

- Hypothetical or backtested performance may not reflect the impact of actual market conditions.

- Trading and investing involve substantial financial risk and can result in loss of capital beyond the initial investment.

- Users must use individual discretion and independent judgment while interpreting signals, strategies, or chart setups.

- Automated signals or scanners are tools for evaluation—not trading instructions.

- TrendCharts content does not account for personal financial conditions, goals, or investment profile.

- Before making any financial decisions, consult with a licensed financial advisor or SEBI-registered professional.

- Do not rely solely on any information presented on our site for actual trades.

- Datafeeds and information may be delayed as per data vendor policies or exchange requirements.

- We do not guarantee the real-time accuracy, timeliness, or completeness of such data.

- No legal claim may be made against us or our data providers based on inaccuracies.

- Any user testimonials are individual opinions and may not represent the typical user experience.

- Hypothetical performance results involve inherent limitations and should not be relied upon for real-money decisions.

- All opinions, data, signals, and analyses shared on the website are subject to change without notice.

- TrendCharts reserves the right to modify tools, content, and services at its discretion.

- Our software or product names are for branding purposes only and do not imply any market prediction or financial guarantee.

- No claim is made regarding profitability from any software usage.

- All content—charts, indicators, tools, or data—is designed for testing, analysis, and learning.

- No real-money trading or investment recommendations are provided or supported.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Always remember

Always remember my 3R Rule

my 3R Rule : If the money

: If the money is yours then, risk

is yours then, risk , reward

, reward and regret

and regret are solely yours.

are solely yours.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose. Always remember

Always remember my 3R Rule

my 3R Rule : If the money

: If the money is yours then, risk

is yours then, risk , reward

, reward and regret

and regret are solely yours.

are solely yours.