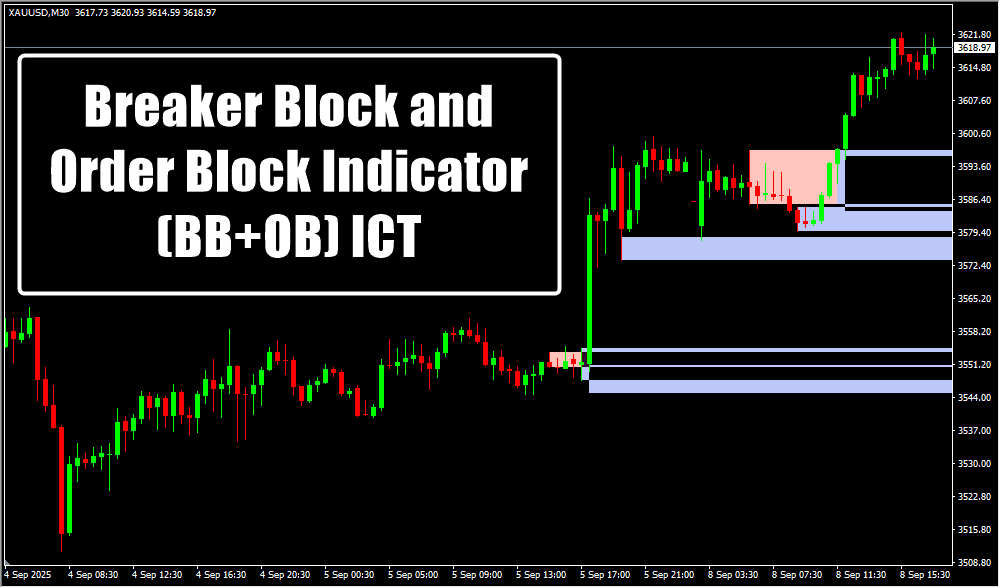

Overview

-

An advanced ICT-style MT4 indicator that identifies where Order Blocks (OB) and Breaker Blocks (BB) overlap.

-

These overlapping zones represent high-probability supply and demand areas.

-

Displays bullish overlap zones in green and bearish overlap zones in brown.

-

Helps traders make precise decisions by focusing on areas of institutional interest.

Core Functionality

-

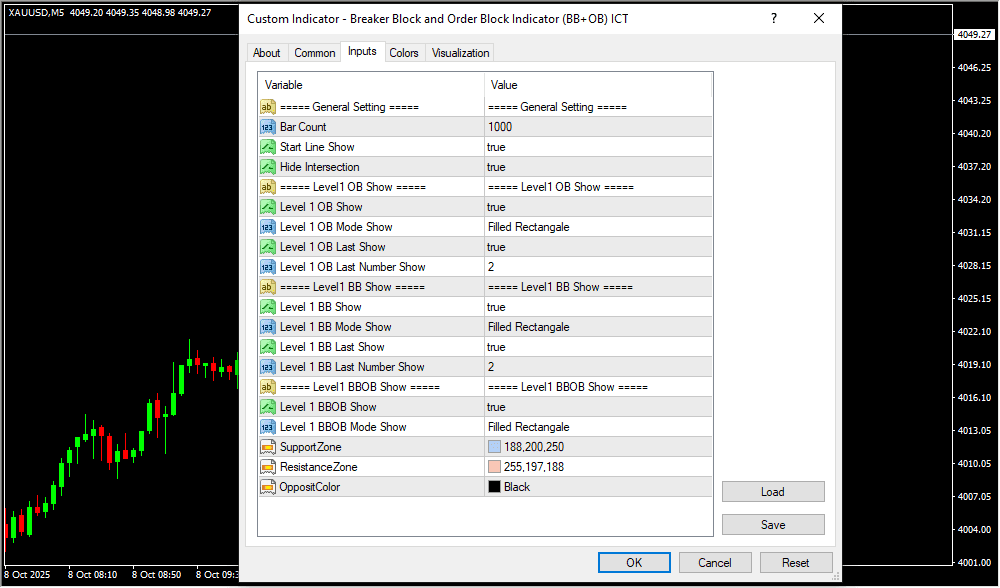

Uses a proprietary algorithm to scan chart structures and detect OB and BB confluence areas.

-

Highlights zones where both block types align, signaling strong potential reversal or continuation areas.

-

Works seamlessly on MT4 across multiple timeframes.

-

Designed for ICT and Smart Money traders who rely on breaker block + order block logic.

Bullish Overlap Zones

-

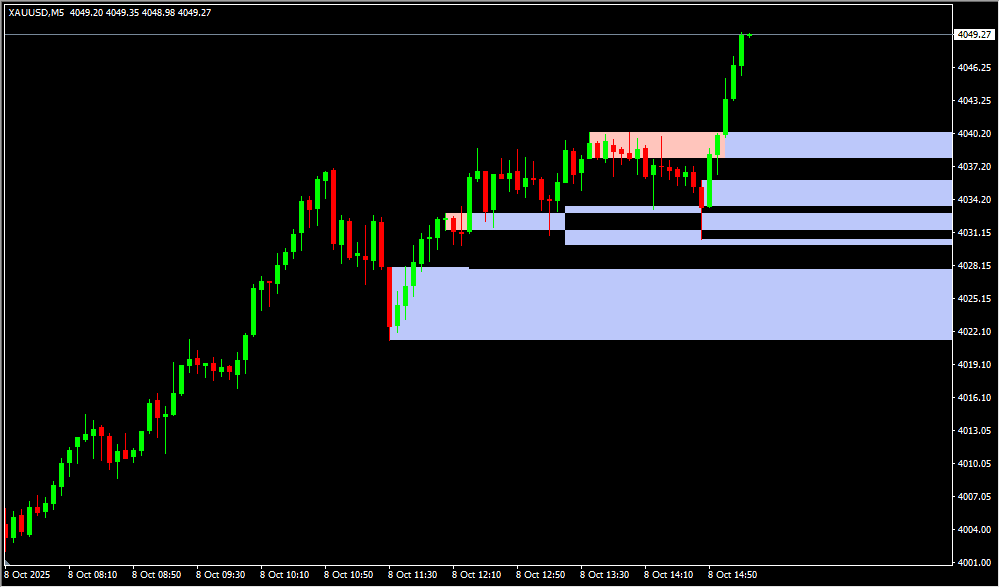

The indicator identifies bullish OB + BB overlap regions in green.

-

A bullish zone forms when:

-

Price breaks structure upward.

-

An Order Block aligns with a Breaker Block.

-

Market returns to the zone and reacts upward.

-

-

Example: On the 15-minute GBP/JPY chart, price taps the green zone and resumes the uptrend.

Bearish Overlap Zones

-

The indicator plots bearish OB + BB overlap areas in brown.

-

A bearish zone forms when:

-

Price forms lower lows in a downtrend.

-

A bearish Order Block overlaps with a Breaker Block.

-

Price revisits the zone and continues downward.

-

-

Example: In the 15-minute EUR/USD chart, the brown zone signals continuation of the downtrend.

Indicator Classification

-

Categories: ICT, Smart Money, Supply & Demand

-

Types: Leading, Breakout, Reversal

-

Platform: MetaTrader 4

-

Timeframes: Multi-Timeframe

-

Trading Styles: Day Trading, Intraday, Scalping

-

Markets: Forex, Indices, Crypto

Key Benefits

-

Highlights high-probability institutional zones.

-

Reduces chart clutter by identifying only the strongest confluence areas.

-

Perfect for Smart Money Concepts (SMC) and ICT methodology.

-

Helps anticipate reversals, mitigation zones, and continuation setups.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose. Always remember

Always remember my 3R Rule

my 3R Rule : If the money

: If the money is yours then, risk

is yours then, risk , reward

, reward and regret

and regret are solely yours.

are solely yours.