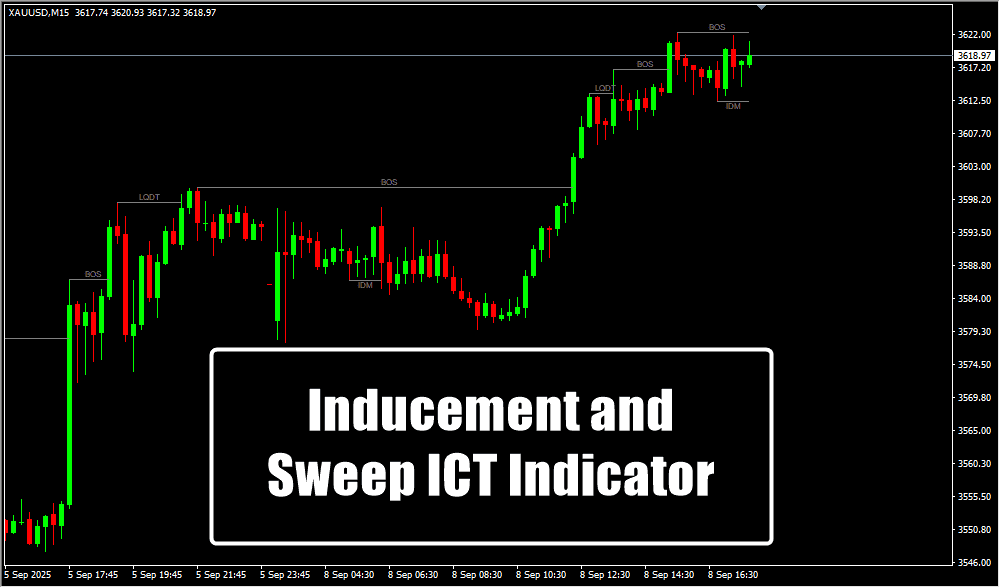

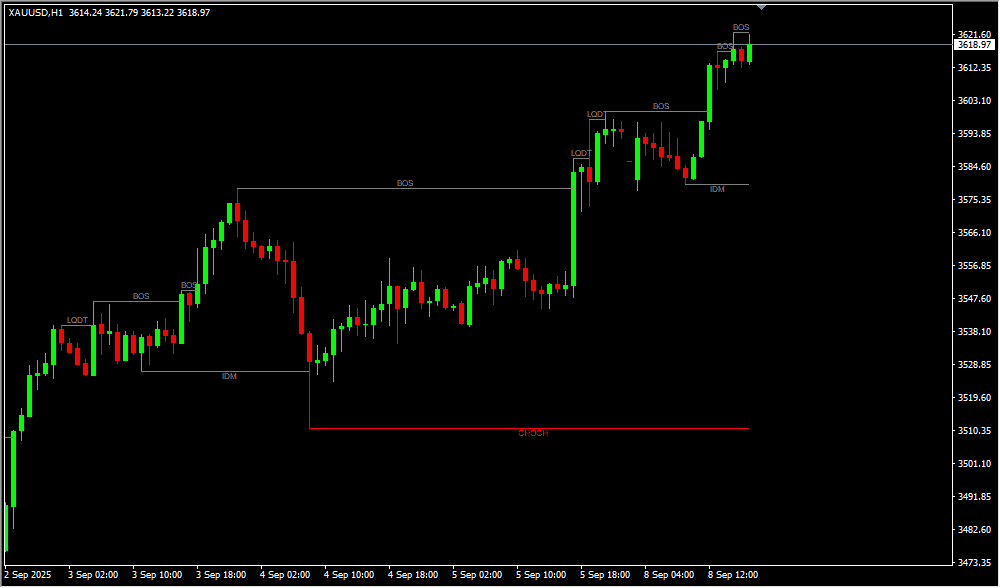

Identifies CHoCH, BOS, Inducement (IDM), and Liquidity Zones automatically on MT4.

Designed for ICT, Smart Money Concepts (SMC), and liquidity-based trading workflows.

Helps traders understand true market direction by marking structural shifts and trap zones.

Detects liquidity hunts where price intentionally sweeps highs/lows to collect orders.

Pinpoints inducement levels—areas where traders are lured into wrong positions before the real move.

Provides a full market structure map to refine entry and exit timing.

Suitable for day trading, scalping, and higher-timeframe swing trading.

Works on Forex, Crypto, Stocks, Commodities, and Indices.

In an uptrend: CHoCH signals trend initiation, and BOS confirms continuation.

In a downtrend: bearish CHoCH and BOS sequences highlight momentum shift and smart money sell structures.

Helps prevent false entries by showing where liquidity sweeps are likely to occur.

Reduces chart clutter by auto-marking structural moves with clean visuals.

Useful for identifying trend reversals, continuation patterns, and liquidity engineering by market makers.

Enhances precision in ICT setups such as FVG return trades, OB mitigation, and liquidity sweep entries.

Allows traders to combine structural analysis with inducement traps for high-probability setups.

Supports multi-timeframe structure mapping, improving overall market context.

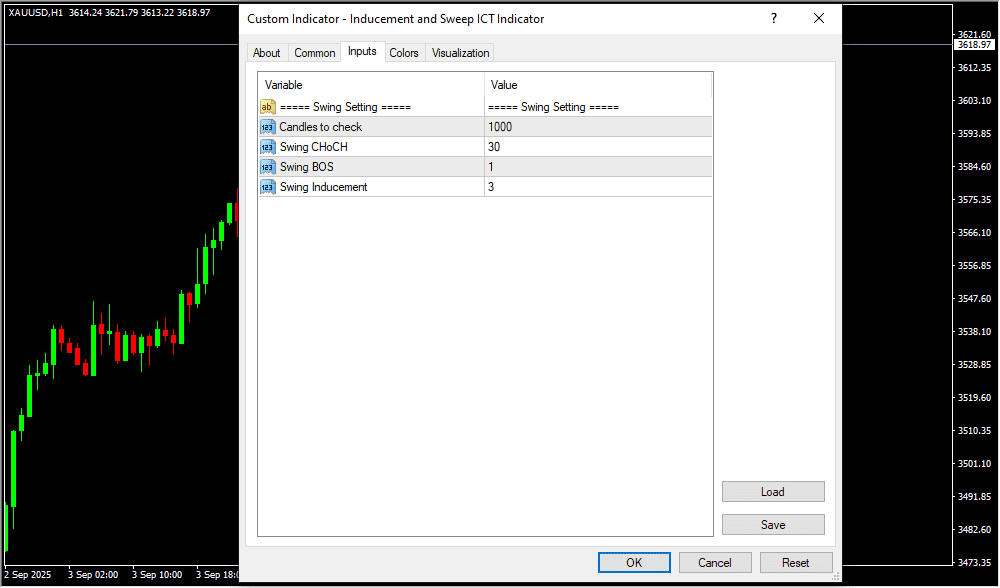

Customizable settings for CHoCH sensitivity, BOS logic, inducement detection, and swing calculations.

Ideal for intermediate and advanced traders studying Smart Money and price-action-based strategies.

Helps traders execute with more confidence by providing objective, rule-based structure labeling.

Risk Disclaimer

- TrendCharts.in and its associated products, services, software, and tools do not provide any offer or solicitation to buy or sell securities, futures, forex, commodities, or derivatives.

- We are not SEBI Registered Investment Advisors or Research Analysts.

- All materials are strictly for educational, informational, and paper trading & help in analysis purposes only.

- We do not provide advice for Real Money Trade, tips, buy/sell recommendations, or investment strategies.

- TrendCharts is solely involved in the development, sell, resale, and distribution of financial market software, datafeeds, indicators, scanners, and tools.

- All our offerings are intended for testing strategies and educational evaluation only—not for real-money trading.

- Users may utilize the software and tools for paper trading or strategy evaluation only.

- If users apply our offerings to actual trading (knowingly or unknowingly), TrendCharts.in or its stakeholders bear no responsibility for any profit or loss.

- Any such use is at the user’s sole discretion and risk.

- We explicitly disclaim liability for any financial loss, trading loss, or damages resulting from:

- Use of our software, tools, or services.

- Decisions made based on any charts, indicators, AFLs, data, or analysis from our products.

- All market data and content provided are subject to delays, inaccuracies, or errors.

- Past performance (actual or hypothetical) is not indicative of future results.

- Hypothetical or backtested performance may not reflect the impact of actual market conditions.

- Trading and investing involve substantial financial risk and can result in loss of capital beyond the initial investment.

- Users must use individual discretion and independent judgment while interpreting signals, strategies, or chart setups.

- Automated signals or scanners are tools for evaluation—not trading instructions.

- TrendCharts content does not account for personal financial conditions, goals, or investment profile.

- Before making any financial decisions, consult with a licensed financial advisor or SEBI-registered professional.

- Do not rely solely on any information presented on our site for actual trades.

- Datafeeds and information may be delayed as per data vendor policies or exchange requirements.

- We do not guarantee the real-time accuracy, timeliness, or completeness of such data.

- No legal claim may be made against us or our data providers based on inaccuracies.

- Any user testimonials are individual opinions and may not represent the typical user experience.

- Hypothetical performance results involve inherent limitations and should not be relied upon for real-money decisions.

- All opinions, data, signals, and analyses shared on the website are subject to change without notice.

- TrendCharts reserves the right to modify tools, content, and services at its discretion.

- Our software or product names are for branding purposes only and do not imply any market prediction or financial guarantee.

- No claim is made regarding profitability from any software usage.

- All content—charts, indicators, tools, or data—is designed for testing, analysis, and learning.

- No real-money trading or investment recommendations are provided or supported.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Always remember

Always remember my 3R Rule

my 3R Rule : If the money

: If the money is yours then, risk

is yours then, risk , reward

, reward and regret

and regret are solely yours.

are solely yours.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose.

Final Note: Trading in financial markets is speculative and may not be suitable for all investors. TrendCharts.in provides various automatic signal setups for Paper Trading & help in Analysis, it is not a “black box” system to be used without careful evaluation. Users must apply their judgment in filtering automated setups, particularly in relation to broader market trends. All trading decisions are solely the responsibility of the individual trader. Trading and investing involve risks, and losses are inevitable, So Kindly use only risk capital and never invest money you cannot afford to lose. Always remember

Always remember my 3R Rule

my 3R Rule : If the money

: If the money is yours then, risk

is yours then, risk , reward

, reward and regret

and regret are solely yours.

are solely yours.